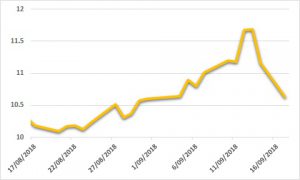

Sugar:

Consecutive weeks of gains were brought to an abrupt end last week, as prices took the elevator down on Friday. Chatter around significantly larger Indian export subsidies saw the prices just shy of 50 points lower after the open. An announcement is expected from the Indian Government this coming week, so it will be important to watch the headlines. After a surprising Commitment of Traders (COT) report last week, the latest COT report released as expected, with specs reducing their net short position from 188,738 to 163,835 lots. In Brazil, ethanol stocks jumped as a reaction to stronger prices. In the face of higher ethanol prices, the Brazilian real continues to weaken as further global trade discussions contain the emerging markets currency. On the weather front, decent rainfall is forecast for Brazil and Thailand, whilst fine weather is expected in India and Australia.

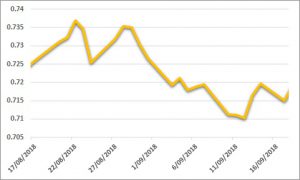

AUD:

It was a quiet start to the week for the AUD, oscillating around USD 0.71. Price action heated up on Wednesday night, with underwhelming US PPI data, and CPI following suit the next day. Thursday was the highlight of the local calendar, with the release of better-than-expected unemployment data. As a result, the AUD traded near the week’s high of USD 0.7229. The AUD’s run was stunted on Friday night as the US rounded out the week with a strong non-farm payrolls print, and it closed the week near USD 0.7150. US President Trump hit the newswires over the weekend, once again threatening tariffs on Chinese imports. There have been muted reactions seen so far, but this week will provide more information about what’s in store. There is little excitement on the data front this week, with the RBA minutes the only key piece of datum to be released.