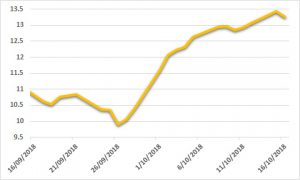

Sugar:

Several attempts to break 13 USc/lb did nothing to deter the market’s hunger for higher prices in the week. The prompt March19 contract now has a firm handle on 13 USc/lb. The trade players met at the London Sugar conference last week, expressing mixed views on the current state of play. Sugar remains difficult at present, with rising ethanol and a stronger Brazilian real bolstering ethanol parity, whilst the speculative market continues to get short into the market’s strength. UNICA’s latest report for 2H September continues to highlight Brazil’s preference for ethanol, with the sugar mix at 33 per cent. In the week ahead, the market will continue to watch for signs of further exports out of India, following the supposed 150kt deal completed last week.

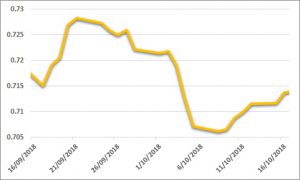

AUD:

US bond yields highlighted the week as the ten-year bonds posted seven-year highs at 3.26 per cent. The yields reflected the US economy and interest expectations, but risk currencies such as the AUD fared generally well. The local data calendar was relatively quiet, as US CPI and Chinese trade data featured. While the market is now short, the bigger picture of US and China trade troubles looms. Nothing is preventing the AUD from popping up on pockets of weakness in US data and trade concerns, however, it is difficult now to see the AUD above USD 0.73.