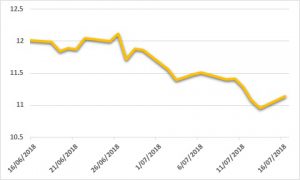

Sugar:

Raw sugar futures were lower across the board this week, with the prompt October18 contract finishing the week below 11 USc/lb. Price action was largely one directional all week as ‘no news’ has been perceived as a reason to continue to sell. Non-index funds added another 10,000 shorts to sit net short 56,300 lots. Sugar market variables remain in play: dryness in CS Brazil is of interest this week, with weather above 30 degrees expected. The monsoon season is progressing well in India and Thailand, with decent rainfall likely to hit both regions this week. This week’s UNICA report for 2H June highlighted a sustained focus on producing ethanol over sugar and higher ATR yields. The market needs to unwind the coming walls of sugar before prices can progress further to the topside. The numerous Thai and Brazilian producers with substantial hedging left to complete will limit a bounce, as the market gyrates in the 11–13 USc/lb range.

AUD:

Trade wars were back into the fray in a bigger and nastier manner last week, with investors becoming more risk averse about the potential flow through effects of a trade war between major global trading partners. AUD price action heated up on Wednesday as headlines claimed US President Trump was looking to impose an additional USD 200 billion on Chinese imports, sending the AUD sliding to fresh 14-month lows at USD 0.7361. In the week ahead, the RBA July meeting minutes are due out, with important employment data released on Thursday. There is little data due out from abroad this week, so all eyes will be on Trump’s meeting with Russian President Vladimir Putin, and Fed Chair Powell’s speech on Wednesday. Participants will be looking for Powell to support the current monetary policy and outlook.