Sugar:

Despite a shortened trading week, raw sugar futures slipped lower from Monday through to the US Independence Day holiday before stabilising near 11.50 to round out the week. Declining ethanol prices and a weaker Brazilian Real helped lead sugar prices lower. The Indian Government alluded to stronger export policies for mills were coming. The latest Commitment of Traders report was delayed due to the US holiday – the markets expects the non-index to have continue to add to their net short position further as at close of reporting period. Sugar will find some joy in a stronger commodity complex through the back end of last week. Key this week, we see the latest UNICA and delayed Commitment of Traders report.

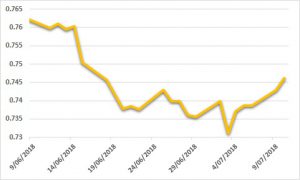

AUD:

The AUD continues to be pushed along by the USD story – in a heightened trade risk environment, the AUD is a loser. As seen in early price action last week, the AUD posted lows, seen last in January 2017. The RBA met on Tuesday leaving rates unchanged and no curve balls to following commentary. Before Friday’s US Non-Farm Payrolls data was released, we saw the minutes from the latest FOMC meeting. Fed members said policy remained accommodative and gradual hikes were needed. US Non-Farm Payrolls were stronger than expected, however the market was more interested in the start of imposed tariffs on China ahead of the weekend. The AUD pushed back above 74 cents to end the week. Only some second tier local data out this week, with US and Chinese CPI and PPI due from Wednesday onward.