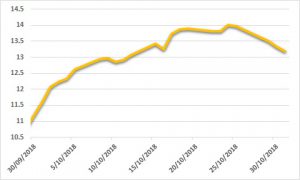

Sugar:

The recent surge in raw sugar prices stalled across the back end of the week, as weaker whites and sentiment weighed on the NY#11. Price action was lively for the month of October as specs helped push prices from 11 to 14 USc/lb. With a lot going on in the market, specs began to unwind, whilst producers got on with some decent hedging. The latest Commitment of Traders report showed the specs moving from a net short to a net long position of 12,500 lots. The macro environment remains volatile, with equities and stocks giving up the past 12 months’ worth of gains. Despite the outlook not looking good, resilience remains at the forefront. With the Brazilian election now complete, a win for Bolsanaro saw a strong knee-jerk reaction for the Brazilian currency, through a key USDBRL 3.60 level. Giving back the gains, the Brazilian real has followed sugar prices lower this week. In the week ahead, we will continue to watch for any signs of Indian exports.

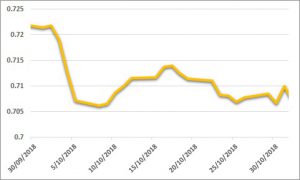

AUD:

A choppy week for the AUD, with numerous attempts above USD 0.71 being rejected. Price action was highlighted by a test of USD 0.70 on Friday night, following some stronger US data. USD gains were eradicated as the finer details in the Q3 GDP numbers were perceived as weaker. There were some key data points this week as, local Q3 CPI was received on target. Local trade balances today beat expectations, helping the AUD one per cent higher to USD 0.7145, at the time of writing. Friday night sees the US trade balances and change in non-farm payrolls data highlighting the calendar. Mixed results are expected by the market, so we are sure to see decent price action around these prints. As always, ongoing trade issues between the US and China are never far from mind.