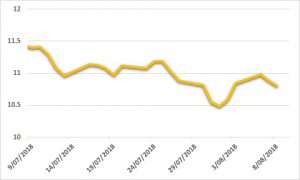

Sugar:

The global surplus remains at the forefront for the sugar market. Open interest has crept above 1 million and the specs have quickly built a decent net short position (net short 134,000). Perhaps we see some capitulation into the October18 expiry—short term directives will be whether March and May get dragged down with it. There is potential to see the lower end of 10.50 USc/lb, but at what point do we bounce? Ethanol parity is seemingly capping the market out at 12 cents. Risk, as has been the case for the majority of this year, remains to the downside. Looking ahead, availability of low-quality Thai sugar will be of interest, with decent carryover stock and the new harvest coming online. The ethanol market will hold interest in Brazil if any improvements can be made to recent declines. The latest UNICA for 2H July due out this week, with no material changes expected.

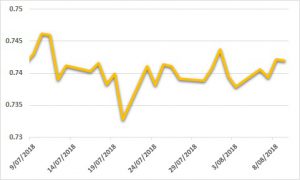

AUD:

Despite the trade war being played out by the US and China, the AUD keeps bouncing off USD 0.7350. There remains no good new news for the AUD, as it gyrates in the USD 0.7350–0.7450 range. Domestic data more recently has been positive, with the RBA keeping rates on hold this week. Concerns over a dip in unemployment highlighted commentary going forward, otherwise, unmoving commentary was provided by the RBA. Choppy conditions lie ahead, trade wars will push to keep sentiment under pressure, aided by instability in oil prices and the commodity complex.