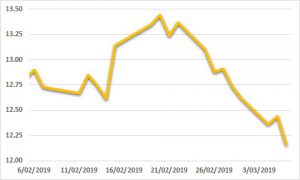

Sugar:

Raw sugar futures continued to slump as the new prompt May19 contract finished the week down 5.1%. The expiry of the March19 contract on Thursday night saw a delivery of 1.038 mmt of sugar, predominantly of Brazilian origin. The Indian Government raised the domestic price of sugar just over a week ago, as the mills’ cries for assistance seem to have been answered. Cane farmers arrears continued to grow, prompting further assistance from the government. Brazil and Australia persist with their lobbying of the WTO against these subsidies. It is yet to be seen whether the subsidies will continue to encourage farmers to grow cane, despite the uncertainty of payments.

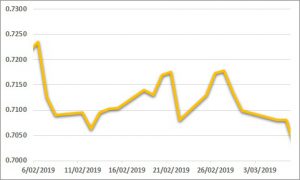

AUD:

The AUD struggled to slow USD momentum over the back of last week, closing the week below USD 0.71. Newswires were highlighted by US President Trump extending the tariff deadline with China, whilst reports out of the UK suggested Prime Minister Theresa May was planning to delay Brexit to delay a no-deal scenario. Local capex data was the only highlight of the domestic calendar, beating market expectations, causing the AUD to make gains back toward USD 0.72. However, US Q4 GDP released much better than expected, erasing any prior gains for the AUD. A quiet start to the current week as the AUD was back above USD 0.71. Comments from US President Trump, suggesting the USD is too high, helped the AUD start on a positive note. A busier economic data calendar will be highlighted by local building approvals, GDP, trade balances, and retail sales data, and the RBA meeting. Abroad, US trade balances data are a precursor to Friday’s non-farm payrolls data release.