Sugar:

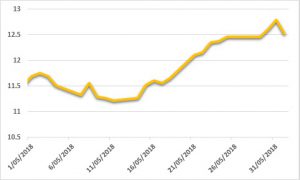

A three-week recovery in raw sugar futures was stopped in its tracks on Friday night. Prompt, July18 contract, stalled a touch below 13 USC/lb, before retracing any headway made in the previous weeks. Newswires were highlighted by the resignation of Brazil’s Petrobras CEO, and fears of a return to a fixed-price gas agreement helped drive sugar prices lower. With large selling pressure above 13 USc/lb, news of rain and an end to the truckers’ strike did little to help sugar markets’ fortunes. The latest Commitment of Traders report covering a shortened trading week that saw specs net short 66,000 lots (a 36,000-lot reduction on the week). India is said to be exploring options for low duty exports to China to the tune of 1.5 mmt. We will be monitoring Indian headlines and potential technical follow-through weakness from Friday in the week ahead.

AUD:

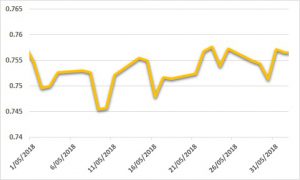

Seesawing price action saw the AUD slide below USD 0.7500 mid-week, before rebounding back above USD 0.75. Positive price action was capped as the monthly US Non-Farm Payrolls data beat expectations on Friday night, with US stocks, treasury yields and the big dollar all higher. A busy week ahead on the economic data calendar, with the RBA meeting on Tuesday and Q1 GDP following on Wednesday. The RBA is expected to leave rates on hold, with little change to the accompanying commentary. Later in the week we see local, US and China trade data.