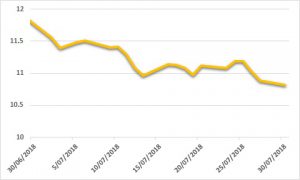

Sugar:

Again, there appears to be no good news about the market this week. The four price levers in sugar have begun to move concurrently—futures, spreads, regional and refining premiums have taken some of the focus off futures as they move. This week we saw spreads weaken—most notably, October/March—and Thai premiums soften, given an uptick in exports. The prompt October 18 contract slid lower on Friday making new contract lows at 10.83 USc/lb. CS Brazil’s harvest slowed as more mills shut, favouring ethanol over sugar. The latest UNICA report for 1H July highlighted that tonnes of cane per hectare (TCH) increased versus the same period last year, whilst the quality of cane continues to impress. In the week ahead, weather developments and spread action should be of keen additional interest for the market.

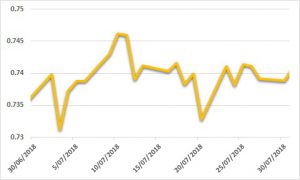

AUD:

It was more of the same for currency markets last week, as the AUD continued to spin its wheels. A quiet economic calendar saw local Q2 inflation data underwhelm and a solid US Q2 GDP doing very little to excite the market. Despite small losses on the week, the AUD managed to hold a USD 0.74 handle. Looking ahead, the data calendar fires up again this week, with China’s expected to have softened. US employment statistics will follow the important FOMC meeting for August. Locally, trade balances and retail sales will be released, but will likely be dwarfed by US headlines later in the day.