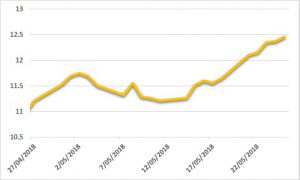

Sugar:

In a shortened trading week, raw sugar futures looked likely to retrace all recent gains on a Commitment of Traders report showing a material reduction in the net short spec position (20,000 lots). Paired more closely with crude oil, sugar followed suit as prices regained prior week losses to finish back above 15 USc/lb. In Brazil, forecasts for the upcoming wet season look favourable for growers, with sufficient – if not more than expected – rainfall. Elsewhere, in India, the harvest is underway with some estimates already being ratcheted higher to around 26 million tons. Looking ahead, tonight we see a delayed Commitment of Traders report, which is expected to show specs net shorter than last week.

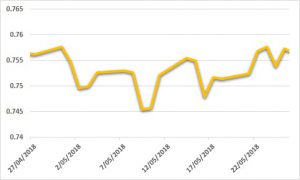

AUD:

The AUD was buoyed back above USD 0.76 by uncertainty around the Fed’s inflation forecasts. Noted in the Fed’s latest meeting minutes, concerns that inflation may remain lower for longer saw the USD and yields slip. Additionally, there were hints of a possible reduction in the number of rate hikes following the almost-certain December hike. Continued USD weakness followed through to week end, as the AUD settled at USD 0.7626. Ahead this week we see Fed Chair nominee Jerome Powell speaking at a confirmation hearing before the US Senate Banking Committee. Markets will be watching closely, as he is likely to state his views for policy going forward. Later in the week, we also see US Q3 GDP and China manufacturing PMI as key data drivers.