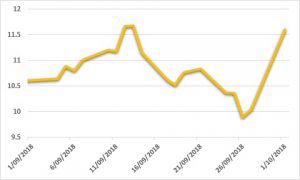

Sugar:

Excluding the most recent trading session, raw sugar futures have continued to slump with the soon-to-expire May18 contract settling at 10.86 USc/lb, with July not too far ahead. This week, the 1H April UNICA report continues to see more ethanol being produced in Brazil. Commodity specialist and commentator Green Pool cut its Brazil forecast to 30.8 mmt from 32 mmt. Additionally, ISMA revised its 17/18 production forecast by 2mmt (from 29.5 to 31.5 mmt). The latest Commitment of Traders report indicates producers are biting the bullet and pricing the front two contracts as their time windows narrow. In India, the export subsidy parade remains in play with the government telling mills they must export. Overnight, prices got somewhat of a reprieve with settlements higher across the board. With the May18 rolling off on Monday night, attention will turn to deliverers and receivers at the tape.

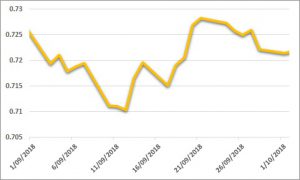

AUD:

The AUD has weakened dramatically this week, as rising US treasury yields propped up the USD. Falling from a one-month high above USD 0.78, the AUD has slid in consecutive sessions to a USD 0.7547 low on 27 April. The recent rise in US treasury yields has been a reflection of interest rate expectations, supported by rising inflation and sustained economic growth in the US. Paired with weaker local data, there has been little reason to suggest the AUD may draw back recent losses. With US treasury yields falling back below 3% overnight, today’s local PPI and US GDP may cause some stir for the AUD.