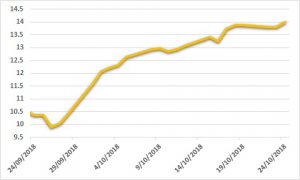

Sugar:

Sugar prices have continued to rally for almost four straight weeks. Numerous attempts to break through recent resistance at 13.95 USc/lb have been made, but finally caved overnight, largely thanks to a better-than-expected UNICA report for 1H October. The report highlights the lower sugar mix (32.2%) as the catalyst for a move higher. As the Brazilian election plays out, a stronger real has seen ethanol parity at 16 USc/lb. In India, question marks are being raised over exports and whether the 5mmt mandatory exports will be filled. Consensus from the London Sugar Week had much of the trade at and around 2.5–3.5 mmt. Looking ahead, the market will be watching Indian production and exports closely before making any changes to expectations.

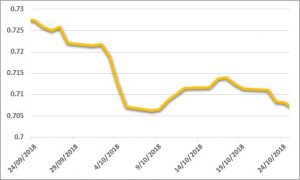

AUD:

Increased investor caution has seen the AUD chop lower over the last week. Despite testing newer lows—on weaker Chinese trade data and hawkish FOMC minutes—the AUD closed the week on a USD 0.71 handle. Local unemployment numbers highlighted the data calendar for the week, whilst the RBA minutes showed policy makers’ concerns about tighter lending standards. A quiet week on the economic data calendar, seeing the AUD drift lower as the market becomes risk adverse to European and US equity sell offs.