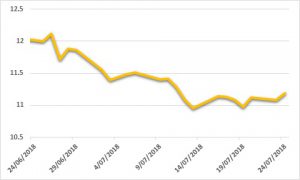

Sugar:

The trading week opened with a bang, raw sugar futures erasing life of contract lows seen in the previous sessions. Some technical adjusting, the market’s reaction to bearish news in China and India was unexpected. A refusal of the 10-cent handle buoying sugar prices back into the 11 – 12.50 range. Still, there is no good news around – China revoke import duty exemptions as trade war pressures mount, India likely to raise their FRP for cane and divergence in the white’s market suggesting tightness in the refined market. The trade surplus keeps getting kicked down the road, tightness in white’s market not helping. Producers will want to be well hedge – as Thai’s and Brazilians with much hedging to complete. This week we see the latest UNICA report for 1H July. Consensus estimates show sugar mix at 39% and 2.4 mmt of sugar.

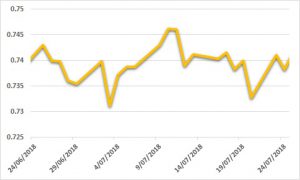

AUD:

Bobbing above and below 74 cents, AUD price action was mixed. Market action lifted when Fed Chair spoke of the Feds intention to continue to gradually raise rates, “for now”. Despite the broader trade tension narrative and geopolitical tensions, the USD appreciated, sending the AUD to 0.7323. Local jobs data came in better than expected on Thursday, nearing 51,000 new jobs in the month. The calendar was quiet on Friday, with the AUD back above 74 cents into the end of the week. Looking ahead, the data calendar is highlighted by local Q2 CPI and US Q2 GDP. Both expected to have risen since Q1. Mixed results should not give the AUD less/ more reasons to break through the current range.