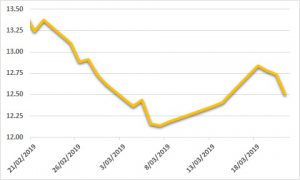

Sugar:

The much-anticipated up-to-date Commitment of Traders (COT) report was released at the end of last week. The report surprised somewhat, with non-index specs showing a net short 126,000 lots, slightly more than anticipated. As expected, Monday night highlighted a 30-point advance on the back of Friday’s COT report. Despite the positive backdrop for prices, led by non-index specs, the rest of the week has seen the market erode much of those prior gains. Softening physicals and white premiums have pushed more producer pricing into raws. Tonight, we get the latest COT report as at close of business Tuesday. There is much expectation that non-index specs have modestly increased their net short positions, but time will tell.

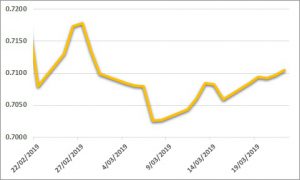

AUD:

A choppier end to the week for the AUD as a more dovish Fed, spurred a solid break above USD 0.71 yesterday. Local unemployment data also gave the AUD a leg up to fresh one-month highs at USD 0.7168. Unfortunately, gains were short lived as the USD clawed back losses overnight on the back of some second-tier jobs data. More dovish than expected, the FOMC’s latest dot plot prediction showed a more relaxed approach to balance sheet normalisation. Fed pricing is now seeing no further hikes in 2019, with just one in 2020. Local employment data surprised yesterday, with the unemployment rate down to 4.9% in February. As the week draws to a close, the AUD looks set to close on a 71-cent handle. The AUD continues to gravitate around USD 0.71, despite positive local employment numbers. We continue to watch the trade spat between the US and China, and the eventual fallout of Brexit, for more sustained moves.