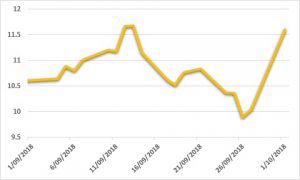

Sugar:

India highlighted the newswires this week, with the sugar market receiving confirmation of the long-expected Government subsidy for Indian farmers. The expired October18 contract slipped below 10 USc/lb following the announcement of a five-million-tonne export subsidy, which kicked off on 1 October. The now-expired October18 contract rolled off the board on Friday night without much fanfare, with Dreyfus taking delivery of 271,120 tonnes of predominately Centre South Brazilian sugar. The latest Commitment of Traders report did little to excite the market, despite specs increasing their net short position by 18,000 lots for the week. Looking ahead, the market will sit tight as we wait for signs of the Indian export program kicking off.

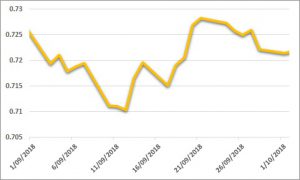

AUD:

The AUD chopped into lower ground as the US FOMC meeting provided the only stimulus of significance for the week. As expected, the FOMC raised rates on Thursday morning. The accompanying statement highlighted the removal of key wording around ongoing policy being ‘accommodative’. The AUD reacted accordingly, steaming through USD 0.73, before gradually sliding as Fed speakers put out the flames on the significance of the statement. A busier week ahead for the economic data calendar, with the RBA meeting on Tuesday before we see local trade and retail sales data released later in the week. The US monthly, trade balance and non-farm payrolls print data will be released on Friday night.