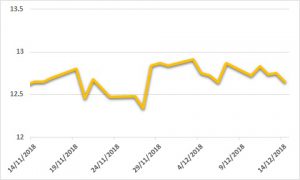

Sugar:

There is still not much new news about for sugar. Price action was highlighted by a weaker opening, but closed unchanged on Thursday night, remaining largely in line with oil and outside markets. UNICA released its latest report for 2H November on Tuesday, with heavy rain across the region continuing to weigh on the harvest. Friday’s Commitment of Traders report showed specs had reduced their net short position by 9,000 lots, to a new net short of 28,500. With the fundamentals remaining at bay, attention firms on northern hemisphere crops kicking off. Harvesting conditions in India have been favourable to date—some reputable market intelligence sources are now revising their 2018–19 estimates higher on a better-than-expected Indian crop.

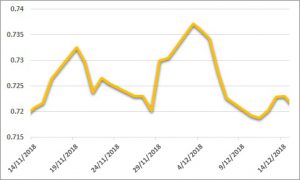

AUD:

A disappointing end to the week for the AUD, struggling to hold a USD 0.72 handle on Friday night, thanks mostly to some weaker Chinese economic data and heightened concerns for global growth. Chinese retail sales and industrial production showed signs of the battering it has taken from the extended trade spat. Looking ahead, this week’s economic data calendar is full of excitement and announcements. Locally, we see the RBA meeting minutes before key unemployment data is released on Thursday. Elsewhere, the calendar is highlighted by the US FOMC rate announcement on Thursday morning. The market is pricing a 75 per cent chance of a US 25 basis-point rate hike on Thursday. Pressure from the White House may have an impact on the Fed’s commentary regarding further hikes in 2019.