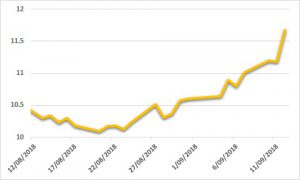

Sugar:

Sugar producers across the market have enjoyed the recent lift in sugar prices over the past two weeks. After trading at prompt life-of-contract lows, the soon-to-expire October18 contract staged a rally, seeing it above 11 USc/lb. The latest UNICA report for 2H August was released overnight, highlighting a small increase against expectations, however, overall output remains below last season’s. In India, the government is yet to provide a policy for exports. In an election year, it seems inevitable the government will do all it can to incentivise exports. Friday night’s Commitment of Traders (COT) report stunned many as the specs moved to a new record net short position—188,738 lots net short. The next COT report will be of keen interest this week. Prices rose across the shortened trading week, whilst specs continued to build their short positions. Watch this space.

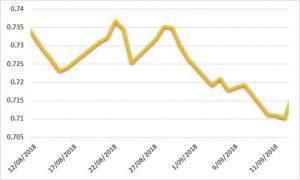

AUD:

A bumpy ride for the AUD over the past week, oscillating through USD 0.7160–0.7230. The RBA met on Tuesday, leaving rates on hold as expected. The accompanying statement (which was the main focus for most) maintained a neutral stance, without mentioning the highly publicised independent rate increases passed on by local banks Westpac, ANZ and CBA. Local trade data impressed mid-week, with export margins climbing above imports. The AUD opened higher on Friday, before gains were pared back on firming US data on Friday night. The data calendar this week is highlighted by the release of local employment data (stronger) today and US retail sales data tomorrow.