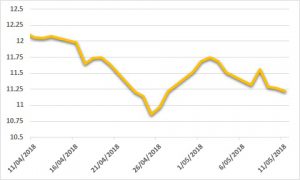

Sugar:

Raw sugar futures have enjoyed consecutive gains on the week. During a week that featured the Brazilian half-yearly sugar week, prompt March18 surged from a 14.23 USc/lb low on Monday, to settle near 14.99 USc/lb week highs on Friday night. Global surplus and tightness concerns were moderated as the potential for less sugar in Brazil held participants’ attention. In the coming week, we see a delayed Commitment of Traders report (delayed due to US Veterans Day) and the UNICA Report for 2H October. We expect these releases to provide a better outlook on Brazilian sugar output going forward.

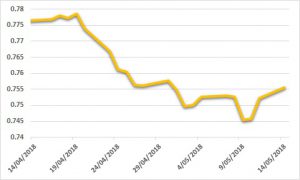

AUD:

A quietly choppy week for the AUD, sitting in a 74-point range. Downside pressure was relieved as plans for US tax reform stalled, allowing the AUD to hold back above USD 0.7650. During the week, the RBA rate announcement was uneventful – no material change to commentary or rates. China trade, CPI and PPI data released much alike, with very little reaction from the market. Commodities and commodity currencies fared well as crude oil made strong gains on the week, following political uproar in Saudi Arabia. In the week ahead, local data is highlighted by unemployment (Thursday) paired with US and China retail sales. Given the unlikelihood of material changes domestically, the US tax reform story and rates will hold the market’s attention going forward, limiting any upside if all plays out true.