Sugar:

Large swings either side of 12 USc/lb are the norm in this week’s daily sugar chart. Raw sugar futures seesawed on a weaker Brazilian real, allowing for heavy producer selling to be absorbed by fund buying. The Indian Government announced its relief package for the struggling local sugar market—a three-million-tonne stockpile with costs covered by Government, a floor of INR 29,000 per tonne for the domestic sugar price and further incentives to assist mill payments to struggling farmers. The latest Commitment of Traders report showed a reduction of 41,000 lots with non-index funds nearing 25,000 lots net short. This week we will see the latest UNICA report for 2H May, with expectations we will see a significantly lower sugar mix with the recent truckers’ strike giving mills little choice but to produce ethanol.

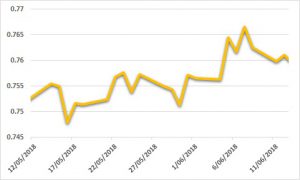

AUD:

Topside momentum for the AUD stalled last week above USD 0.7675. Quelled by the larger macro sentiment, local retail sales and Q1 GDP did their bit to sustain downside pressure on the AUD. Retail sales came in better than expected, as did the quarterly GDP print on Wednesday. The RBA left rates on hold as expected, with little to no change in accompanying commentary, which saw the AUD briefly below USD 0.7600. Friday saw a sell off in emerging markets due to uncertainty over the highly anticipated US-North Korea summit in Singapore. At the time of writing, the summit had concluded—’successfully’, according to many headlines over the past 24 hours. US President Trump has said the meeting was justified because it led to a ‘secured commitment for denuclearisation’. The USD has performed well since, with CPI data releasing in line with expectations. Tomorrow we see the much-anticipated FOMC meeting for June 2018. The Fed are 91% priced to raise interest rates by 25 basis points. Much attention will remain on the forecast projections for further hikes in 2018/2019.