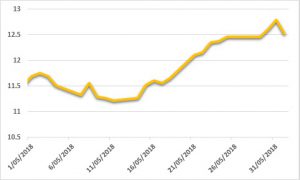

Sugar:

Raw sugar futures struggled to hold a 15-USc/lb handle as prompt March18 contract slid more than 100 points on the week. Largely led by a sharp weakening in crude oil prices, raw sugar futures have reversed all gains from the past six weeks. The start of the Indian harvest has seen estimates come in higher than expected, adding further downward pressures. Fundamentally the market continues to look bearish, and attention now returns to global surplus size and timing. Alongside India, northern hemisphere crops appear to have started well. With the Brazilian tail end likely to favour ethanol over sugar, it is unlikely to bring us back to balance.

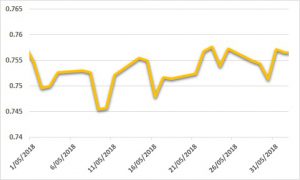

AUD:

Recent AUD strength has all but evaporated for the time being, as the USD returns to the forefront. Led by supportive news on US tax reform and the beginning of the US balance sheet normalisation process, the AUD has tested underlying support at USD 0.75. The RBA was unchanged in rates and commentary, with strong local retail sales highlighting AUD price action. In the week ahead, markets are looking at Thursday’s FOMC, which will be watched eagerly for any hints surrounding normalisation in 2018 and beyond. We also see local employment and consumer confidence data as key drivers domestically.