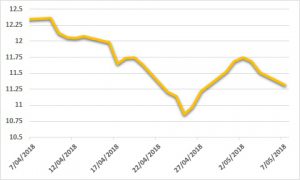

Sugar:

The recent freefall in sugar prices took a break last week as sugar prices found some support below 10 USc/lb. The new prompt, Jul18, traded higher though eventually settled the week in arrears. The May18 contract expired with a 1mmt delivery of sugar at the tape. Brazilian origin, Wilmar and Dreyfus highlighted the expiry, delivering 655kt and receiving 610kt respectively. India is one step closer on subsidies, announcing a subsidy worth 55 INR per tonne. Global prices will need to rise, or domestic prices fall, to encourage Indian millers to export. Either way, one of these levers will need to move, with mandatory exports needing to be met. This week sees the annual New York sugar week. Chatter is expected to highlight concerns around drier weather in Brazil and the impact this will have on older cane and yields.

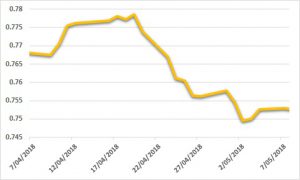

AUD:

The AUD remained under pressure this week whilst US yields retreated below 3%. A busy week on the economic data calendar, with the RBA highlighting higher-than-expected forecasts for inflation and a miss in the latest Non-Farm Payrolls data on Friday night. Employment data did little to diminish intensity around rate hikes this year, with the market pricing another hike at the FOMC June meeting and a fifty-fifty chance of three hikes in total this year. Trade tensions continue to weigh heavily on the AUD, with Trump announcing overnight that he will reimpose sanctions on Iran for a breach of the 2015 nuclear deal. US CPI and PPI data will highlight the data calendar with local CPI the only print of note this week.