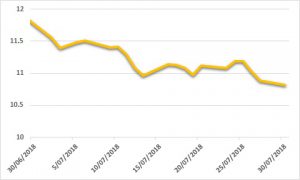

Sugar:

Raw sugar futures have struggled to break free of the last month’s 13–14 USc/lb range. On Wednesday, an aggressive upward revision by India’s ISMA drove the market lower, with production and export estimates for the upcoming crop up from 26mmt to 29mmt. The past month has seen the March 2018 contract expiry, which saw a delivery of over 700kt of largely Brazilian sugar to Alvean and Wilmar, the largest receivers. Elsewhere, the Thai harvest and northern hemisphere crops continue to track well. Looking ahead, the market is still ‘talking’ about a statistical surplus, however, we are yet to see this manifest in the physical trade flows.

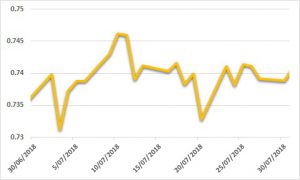

AUD:

A volatile month for the AUD, testing highs near USD 0.80 before sliding to near USD 0.77. AUD strength stalled in response to the latest FOMC meeting, where the committee indicated that US interest rates may have room to move higher, with faster-than-expected inflation growth. A struggle to shift momentum for the AUD changed last week as President Trump announced proposed US tariffs for steel and aluminium. The RBA left rates on hold, with minimal change to the policy statement. Friday’s US Non-Farm Payrolls data will hold markets’ attention, with most expecting continued solid growth.