Sugar:

Raw sugar futures seesawed across a 58-point range last week. Mid-week highs were dashed, before eventually settling near the week high on Friday night. Market fundamentals remain solid as the specs historical net short position and ethanol parity in Brazil continue to keep prices at bay. The latest Commitment of Traders report confirmed expectations, and specs reported 176,000 lots net short across the reporting period. The annual Dubai Sugar conference kicked off over the weekend, so we will be listening out for views from the traders over the coming days.

AUD:

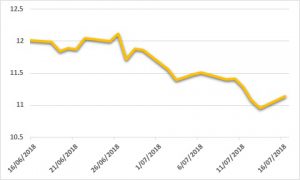

The AUD remained under pressure into the end of the week as US Payrolls data released better than expected. In addition to lingering weakness following a soft CPI print, the AUD closed at the week’s low. In the week ahead, the RBA meets on Tuesday, with no change to rates and commentary expected. We also see local trade balances, retail sales and China trade data as key indicators out this week.