Sugar:

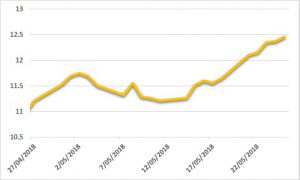

There have been positive signs for raw sugar futures in the past two weeks, with price action showing consecutive gains across the fortnight. Dry weather with ageing cane and the logistical impact of striking truck drivers in Brazil helped lead sugar prices higher this week, whilst mention of a potential 3 mmt buffer stockpile highlighted market newswires. The latest UNICA report released in line with expectations – sugar mix lower at 37.5%, supported by oil prices at USD 75 per barrel. Following pronounced moves in the market, the latest Commitment of Traders report continues to see a reduction of the net short position being held. With no obvious effect, the commercial sector continues to sell into market strength as expected. Looking ahead, potential Indian stockpiles and weather in CS Brazil will hold much of the market’s attention.

AUD:

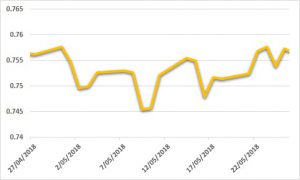

The AUD has consolidated from USD 0.7800–0.7450 over the past month, much to the delight of exporters. The consolidation is a reflection of US interest rates retracting from their highs, and less tension around trade wars between the US and China. The Fed showed no interest in accelerating its rate hike program, whilst hinting that a June hike was possible. RBA Governor Low spoke this week, suggesting foreign debt may be the biggest risk to the Australian economy. US ten-year yields have dipped below the key 3% level, which should help sustain the AUD around USD 0.7550 in the near term. There is no key local data out this week, with the US Non-Farm Payrolls data the highlight of the calendar on Friday.