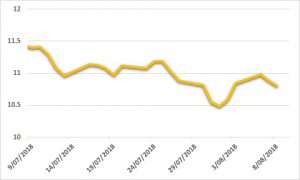

Sugar:

On the back of further upward crop revisions in Thailand and India, raw sugar futures printed fresh lows, seen last in September 2015. In addition to further upward crop revisions, the Indian Government announced a scrapping of their export quota this week, as fears of even more sugar on the global market shook the sugar market. Trade flow tightness remains, increasing the window for a potential weather event. Thailand and Brazilian producers remain underpriced which suggests the market sees pockets of capitulation as we near contract expiries in the medium term. Looking ahead, Brazil and its ethanol output will begin to be watched by more as many speculate on how much sugar and ethanol is produced this coming season. The latest UNICA report shows ethanol output much higher than the same period last year.

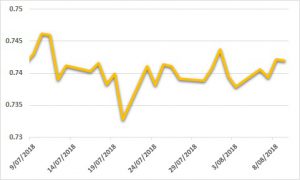

AUD:

The AUD is being led by a strong macro USD and Euro theme. With the US transitioning out of a period of low economic growth paired with a wild, ‘spur of the moment’ President, investor money is flowing out of the US and into the Euro, dragging the AUD along with it. Volatility has spiked alongside a significant fall in iron prices. Historically, when interest rates are lower in Australia than they are in the US, the AUD struggles. It is difficult to ignore a strong USD and Euro, whilst locally there is very little to support the struggle. A short week for markets given the Good Friday public holiday, with very little on the economic data calendar. Expect price action to ramp up again next week as markets return from the long weekend and there is a bigger window for US President Trump to reply to China’s trade responses.