Sugar:

Further weakness was seen last week as prices fell all the way to Friday night. Prompt March18 contract found decent support near 13 USc/lb to settle the week at 13.25 USc/lb. The latest Commitment of Traders report showed non-index funds at a net short 103,000 lots – 74,000 lots higher on the week. Given the continued fall in prices, many expect this number to be closer to 140,000–150,000 lots. In India, the Government revised their production estimates for the season higher. Consensus now sits around 26.1–26.5 million tonnes. In Brazil, weather forecasts remain average for the rest of the wet season, whilst most of the attention is now on how much ethanol will be produced.

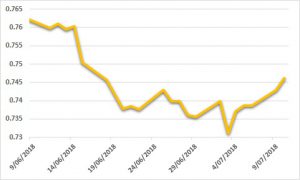

AUD:

The AUD maintained a USD 0.80 handle, ensured by weakness flowing from the US Government shutdown on Friday night. AUD price action was highlighted by some stronger local employment data, which triggered the run to a USD 0.80 handle. The economic calendar for the week ahead is quiet locally, with IS Q4 GDP, manufacturing PMI and mortgage applications highlighting the week’s data releases.