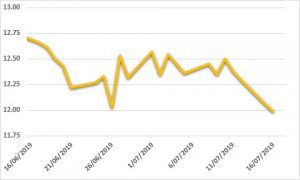

Sugar:

There was a record delivery for the July19 contract expiry as a remarkable 2.1 mmt of sugar was delivered to the tape. There was much focus on the origin of sugar delivered, as the market attempted to gauge how much Thai sugar remains without homes. Delayed final confirmation of origins showing 600kt of Thai sugar was delivered, which is rare against the July contract. July traded a tight range in the months leading up to expiry and it seems the now-prompt October19 contract has followed a similar trajectory. Brazilian mills continue to minimise sugar output as demand for ethanol and firm US corn prices support ethanol prices. Ethanol parity is above 13 USc/lb and is expected to trade near 14 USc/lb later in 2019. The Indian Government is set to approve another tranche of 5mmt of exports, with weather being the key driver for the region. There is potential for an underwhelming monsoon to impact the export tranche. Looking ahead, we expect sugar prices to trade into higher ground over 2H 2019, capped by the ability of the Brazilian millers to alter their sugar mix.

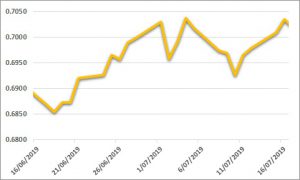

AUD:

A weaker USD in the face of an impending historical US interest rate cut by the Federal Reserve has seen the AUD bounce back above USD 0.70. The latest US FOMC meeting minutes highlighted more monetary accommodation as necessary to help lift inflation back towards the bank’s target two per cent. With the market now pricing a rate cut at the end of July, the timing seems no longer to be in doubt, but the size of the cut remains open to speculation. Looking ahead, RBA July meeting minutes are due out this week with the market looking for hints around the timing of another rate cut at home. We also see the latest employment data as a key driver of further monetary action by the RBA.