Sugar:

After a strong performance over the Christmas break, raw sugar futures slipped dramatically last week. Since posting fresh five-month highs, the prompt March18 contract has wiped nearly all gains in two weeks. A shortened trading week (due to the observance in the US of Martin Luther King Day) saw the market close on the front foot. Expect to see some of this follow through when the US returns from the long weekend. In Thailand and India, weather remains accommodating as respective harvests continue to flourish, with increased output estimates. In the week ahead, weather remains favourable, whilst a keen eye on ethanol parity levels and the Brazilian real will be key drivers.

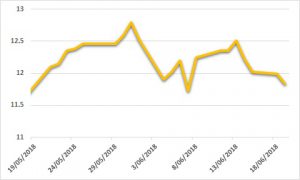

AUD:

The AUD enjoyed a strong rise through the end of 2017 and the beginning of 2018. Five-month highs continue to hold as the AUD traded through USD 0.7900 on the week. Stronger than expected US CPI data did little to stifle a rampant AUD, which will look to test USD 0.80 this week. The local data calendar is highlighted by employment data this week, with expectations for solid growth set to hold firm. Later in the week we also see the latest China GDP and retail sales, which should be kept at bay by local employment data.